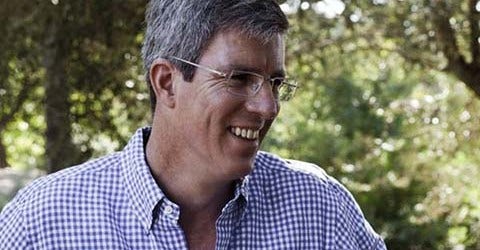

While it’s uncertain what sentence lies ahead for Terroir Capital founder Charles A. Banks IV, it is definitely clear that his guilty plea to wire fraud will change his role in the wine industry.

“Chances are really good he’ll be out of this business for quite a while,” said a prominent San Francisco beverage lawyer who did not want to be identified.

Banks, a financial adviser, will be sentenced on June 27 for deceiving retired San Antonio Spurs player Tim Duncan into investing millions in sportswear company Gameday Entertainment. He was initially indicted on four fraud counts last year in federal court in San Antonio, Texas. However, he pleaded guilty to a reduced charge of one count of wire fraud on April 3.

Although federal law provides for a 20-year prison term, U.S. District Judge Fred Biery could sentence him to a shorter term depending on recommendations from the probation department and arguments by prosecutors and defense attorneys. The related documents have been filed under seal.

Neither John E. Murphy, Banks’ attorney, nor prosecutors from the U.S. Attorney’s Office for the Western District of Texas would comment on the case.

Banks also faces a related civil lawsuit in Atlanta federal court brought by the Securities and Exchange Commission. A lawyer close to that case said he expects it to be resolved after Banks is sentenced in San Antonio. An SEC spokesperson would not comment.

A Case of Good Character

Although neither case is directly related to any of Banks’ wine businesses, the fact that Banks has pleaded guilty to wire fraud is having an impact both here and abroad due to laws that prevent convicted felons from owning liquor licenses and permits. In addition to his role at Terroir Capital, which owns or manages 11 wineries through Terroir Life, Banks, who once co-owned famed Screaming Eagle, remains a co-owner of Napa’s historic Mayacamas Vineyards.

Meanwhile, New Zealand authorities are considering whether Banks can keep his ownership role in the Trinity Hill winery, which is part of the Terroir Capital portfolio. The New Zealand Overseas Investment Office (OIO) issued a statement in April following Banks’ guilty plea that it was considering whether he remains “of good character.”

The regulator said at the time that if Banks is found not to be of good character, it will seek to have him removed from control of the winery.

“Our investigation is close to completion but we are aware that the sentencing hearing for Mr. Banks is due to take place shortly which will provide more information,” an OIO spokesman said in a June 15 written statement. “We are aware, and in discussion with Terroir’s representatives, about a reorganization of Terroir.”

After the federal indictment was issued, Terroir Capital announced that Banks would step down as CEO and be replaced by former COO Kevin McGee. McGee said in a phone interview that Banks is no longer involved in the day-to-day operations of the company, but that he is still “present.”

Much like New Zealand, California’s Business and Professions Code addresses the character of owners and operators in the alcoholic beverage industry. Among reasons that the state can suspend or revoke licenses is “the plea, verdict, or judgment of guilty, or the plea of nolo contendere to any public offense involving moral turpitude.”

Several legal experts, not involved in the Banks litigation, said they believed the defendant’s crime would constitute moral turpitude.

Mayacamas’ Licenses and Permits Could be in Jeopardy With Plea

Indeed, the Schottenstein family, with whom Banks owns Mayacamas, filed a lawsuit in April in Napa County Superior Court to force him to step down as a director of the winery. The suit alleges Banks’ guilty plea puts important Mayacamas’ state and federal licenses and permits at risk for suspension and revocation, according to a published report.

The guilty plea, which is at the heart of the litigation, was made to a superseding indictment that states Banks, acting as an investment adviser, induced a San Antonio victim, identified as T.D., to loan $7.5 million to sports merchandiser Gameday in 2012. The next year, Banks convinced Duncan to personally guarantee another $6 million loan made to Gameday by Comerica Bank.

Banks, who was Gameday’s partial owner and chairman of the board, did not disclose to Duncan that he was personally making millions of dollars from the transactions.

In 2015, Duncan sued Banks, with whom he had invested for nearly two decades, over a series of deals that he alleged cost him $20 million.

Last Updated: May 4, 2023